Facilities management is an important feature of business strategy, brand development, customer satisfaction, and business growth. A facilities program communicates something essential about the values of your organization. If the floors in a major retail store are dirty, sticky, or in serious disrepair, you aren’t likely to conclude that the company values the comfort and safety of its customers and associates.

If you run a business, this discussion doesn’t come as a surprise. But the work of maintaining exceptional facilities often amounts to a considerable expense. Your business might have hundreds of locations. And each location presents different needs—work order frequency, trade focus, and environmental factors will vary wildly across your portfolio.

With these challenges in mind, it’s important to control costs and maintain quality across a number of spend categories in maintenance. To do that, most facilities decision makers tend to keep close tabs on spending related to direct costs: Labor rates, hours worked, materials costs, trip charges, administrative fees, and taxes.

But as a result, facilities managers and other stakeholders miss out on the big picture. You could lose focus on the broader set of costs associated with a facilities management program. By focusing solely on the price of your average maintenance invoice, you expose yourself to a Pandora’s box of costs that you might not be fully aware of.

So beyond the number at the bottom of the invoice, what do we find?

The costs of your facilities management program are just as interconnected as the different components of your facilities. To get the most realistic and detailed picture of your maintenance program, it’s important to adopt the perspective of total cost of ownership.

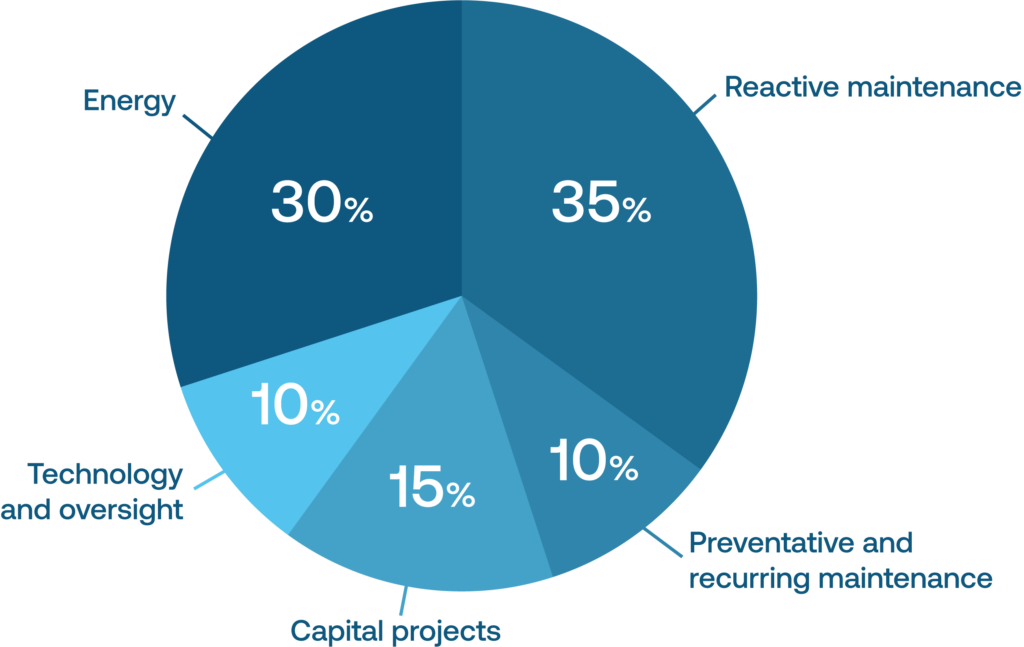

And here’s how it stacks up.

(Estimates based on typical facilities management programs across industries)

Reactive maintenance: What’s generally thought of when the word “maintenance” is discussed. Your reactive maintenance budget is what’s set aside for break and fix work, which ordinarily appears as the result of wear and tear. This cost category might be put together from several different sources. For example: Work performed by your own technicians is budgeted differently than work performed by third-party service providers, even if either group is performing the same kinds of maintenance.

Preventative and recurring maintenance: Maintenance spending allocated to help reduce or avoid the costs associated with reactive and otherwise unplanned maintenance. Routine HVAC tune-ups, floor care treatments, plumbing checks, and so on all fall under this category. Most preventative maintenance work is scheduled on a recurring basis. But it’s unlikely that your recurring maintenance work will all be done on the same schedule, since different work requires different cadences to be effective. Plan accordingly.

Capital projects: Costs related to larger projects across your portfolio. The specifics of how these funds are distributed is a conversation between facilities decision makers and a corporate finance team. But here, consider work like large-scale HVAC replacements, store construction projects, expansions, and brand refreshes as aspects of capital expenditure.

Technology and oversight: This includes whatever costs are tied to your work order management system (CMMS), as well as the software license price, the cost of routine software maintenance, and costs related to on-demand support. Sourcing, vetting, and ultimately rolling out a work order management solution involves more than your company’s facilities department, and more than your technology support team. It should also include the decision makers from your company’s legal, human resources, finance, and other departments.

Energy: This cost bucket is usually straightforward. Think utility bills, energy management software and related devices, like sensors and controls operating in the Internet of Things (IoT).

You’re investing money into each of these spend categories whether you know it or not, whether an explicit business strategy has been put in place to control for these variables or if they’re simply accounted for on an ad hoc basis at the end of every month.

We’re of the opinion that it’s better to consider each of these spend categories as interdependent parts. And once you’ve given names to these items on your financial statements, it’s worth knowing how they influence each other.

You learned from Isaac Newton that for every action, there’s an equal and opposite reaction. A similar concept holds true when you’re budgeting your facilities management program with the perspective of total cost of ownership in mind.

If you’ve set aside a budget for something new in maintenance, it should be because you know how that allotment is going to affect another part of your budget.

Some common examples for illustration:

Facilities managers are very used to seeing things break. From the perspective of someone in the field, maintenance is very often a purely reactive game. And the more locations there are within a property portfolio, the more reactive work you can expect. To compensate, facilities managers budget more money to fixing what breaks, as it breaks. But as a consequence, funds in place for preventative maintenance gradually disappear.

If you’re in this position, expect your reactive maintenance costs to grow—and quickly. Too much focus on break/fix work means you aren’t giving enough attention to work that could be scheduled to ensure that things don’t break in the first place. Routine HVAC maintenance means fewer HVAC repairs, which means less asset downtime, fewer opportunities for location downtime, and more resources for longer-term portfolio goals.

Similar to the problem of balancing the needs of reactive and preventative maintenance, reactive spending exposes the need for a strategic focus on resources set aside for capital projects. With too great a focus on day-to-day break/fix work, your facilities maintenance portfolio begins to shut the tap on funds for new assets, business-wide brand updates, location expansions, and much else.

To make the right decisions for the future of facilities capital projects within your portfolio, partner with your organization’s finance team. Making evidence-based choices with regard to whether to repair an asset, replace it, or defer maintenance work means poring over lots of data. This is only practical if your work order management system has been set up to capture the right information—and if your business analysts are prepared to interpret that information on your behalf.

Energy expenditure, monitoring, and management already accounts for as much as 30-40 percent of your entire facilities budget. Now imagine the downstream consequences of simply applying bandage fixes to older assets across your portfolio—like HVAC units—rather than evaluating each asset on a case by case basis.

Older assets tend to be less energy-efficient than their newer counterparts. And experience has shown that long patterns of temporary fixes don’t address the root causes of asset failure. So when costly temporary repairs begin to grow in number, companies find their energy usage increasing at an alarming rate. Given enough data, it would have been easy to show that a simpler and significantly more cost-effective solution would be to replace the energy-hungry assets.

Again, even under ideal conditions, a facilities manager can expect as much as 40 percent of their program budget to be rationed solely for energy use. Consider how little would be required to increase that budgetary designation to 50 percent, or even more.

Even taking into account these few examples, it’s easy to see how interconnected each of your facilities spend categories really is. And the easier it is to understand how each budgetary decision affects the larger ecosystem of budgetary options and possibilities, the more obvious it becomes that an emphasis on labor rates and invoice costs just isn’t enough.

Equipped with this understanding, you’ll have the tools to make more effective budgetary and strategic choices for your facilities maintenance portfolio. Work with other decision makers at your organization to pinpoint the unique goals of your facilities management program. Remember that facilities strategy is corporate strategy.

Whatever your company’s larger strategic goals and values, the direction of your facilities portfolio should help inform them. The total cost of ownership approach is a powerful way to begin.